STIMULUS - INSTANT ASSET WRITE-OFF

As a result of the stimulus package, there are two key thresholds which have significantly increased and may be relevant to the purchase of a new or used motor vehicle.

*** The instant Asset Write-off has now been extended until December 31st 2020. ***

BDO has prepared this information to help you, the customer, evaluate eligibility for this incentive.

Instant asset write-off

New and used motor vehicles designed to carry a load of less than one tonne and fewer than nine passengers, subject to business use, may be able to claim an immediate deduction where the cost is less than $57,581 excluding GST (previously $30,000 excluding GST).

The significance of $57,581 is that this represents the car cost depreciation limit, so regardless that the concession applies to assets up to $150,000 excluding GST, the concession for cars defaults to the $57,581.

For other motor vehicles, e.g. commercial vehicles designed not principally to carry passengers, may be able to claim

an immediate deduction where the cost is up to $150,000 excluding GST.

The motor vehicle must be first used between 12 March 2020 and 30 June 2020.

There is an aggregated turnover threshold of $500m (previously $50m).

What is the tax benefit?

An eligible business will be able to accelerate a deduction for depreciation for assets, including vehicles purchased up to $150,000 excluding GST (subject to business use).

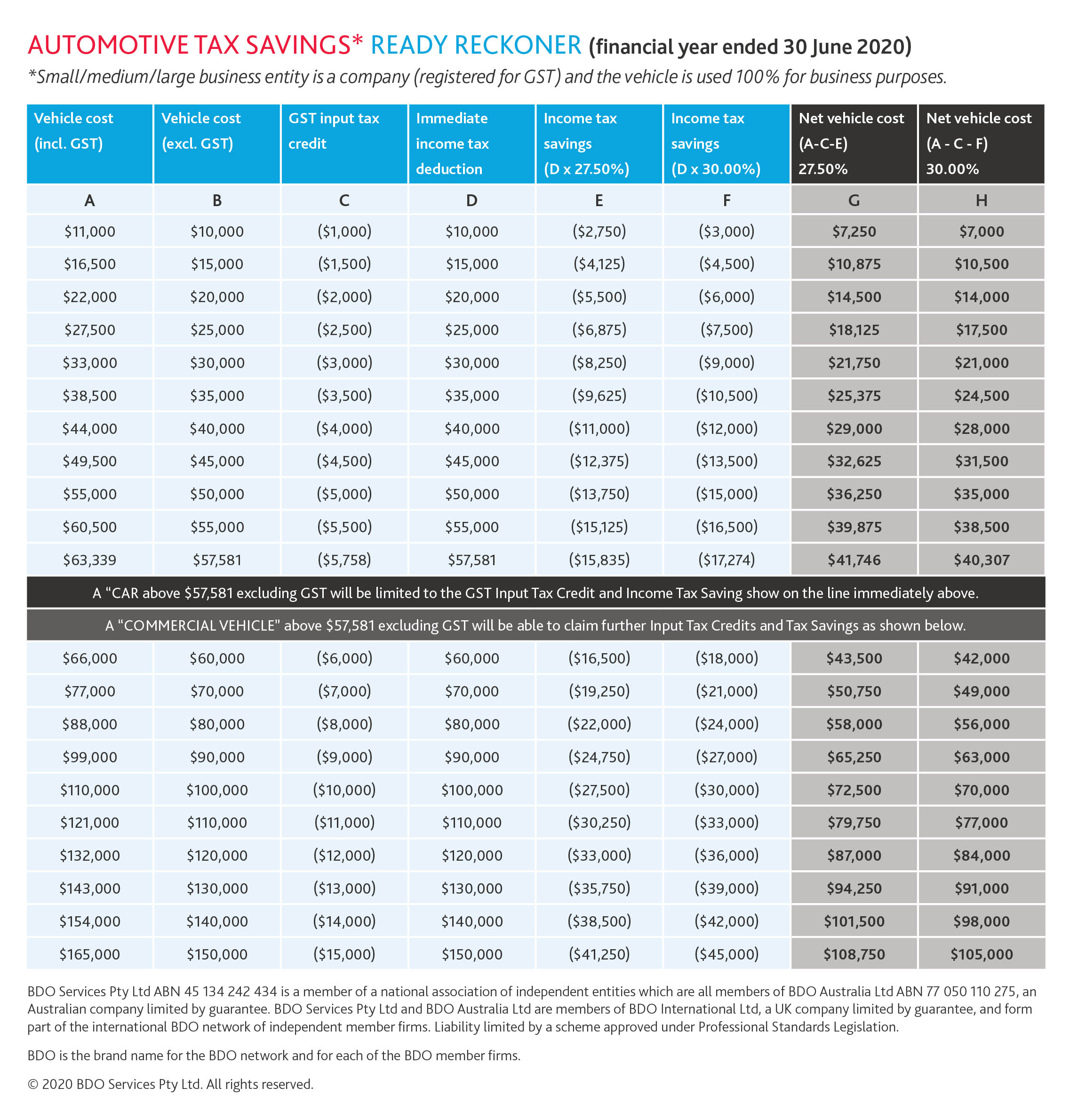

For the income tax year ended June 2020, the income tax rates applicable to small and medium companies are now aligned at 27.5 per cent and 30 per cent for large businesses.

A ready reckoner has been included on the back of this flyer which should help you evaluate the tax savings applicable to the purchase of a new or used vehicle, across a range of values

EXAMPLE

You are a business entity with aggregated turnover of less than $500m and registered for GST.

The entity purchases a new or used vehicle with a value up to $150,000 excluding GST.

The vehicle is first used between 12 March 2020 and 30 June 2020.

The vehicle is used 100% for business purposes.

Your business will be entitled to an immediate depreciation deduction of up to $57,581 (car cost depreciation limit).

BDO COMMENT

The ability to claim accelerated depreciation on eligible motor vehicles offers an excellent tax incentive for small, medium and large businesses.

Please note this information is general in nature and should not be used as a substitute for your own professional advice. Any tax benefit that may be available will be subject to your own circumstances.

ATTENTION ABN HOLDERS

When speaking with your Financial Advisors on the Instant Asset Write off, consider taking advantage of our Commercial ABN Holder Loan Deferral.

- Available on all New and Demo Toyota vehicles

- No payments for the first 3 months of the loan when finance through Toyota Finance

- Commercial ABN Holders only (active a minimum of 12 months)

- Eligible on Toyota Access (max. term 4 years) and Fixed Rate Loans (max. term 6 years)

- Available in conjunction with other finance offers from Toyota Finance

- Available from June to September 2020

Ask one of Sales People for assistance or more information.

For further information visit bdo.com.au